India’s Year over Year GDP Growth slowed down to 5.4%, below expectation of 6.5%

11/29/2024 3:00 pm EST

AJ Economy Trend - Asia Down

India's GDP growth decelerated to 5.4% year-on-year in the July-September quarter of 2024, down from 6.7% in the previous quarter and below market expectations of 6.5%.

Sectoral Performance:

Manufacturing: Growth slowed to 2.2% from 7% in the prior quarter, indicating reduced industrial activity.

Electricity, Gas, Water Supply, and Other Utility Services: Expansion decreased to 3.3% from 10.4%, reflecting a downturn in utility services.

Construction: The sector contracted by 0.1%, a significant decline from the 7.2% growth observed previously.

Agriculture, Livestock, Forestry, and Fishing: Growth improved to 3.5% from 2%, suggesting a rebound in the primary sector.

Services: The tertiary sector maintained steady growth at 7.1%, comparable to the previous quarter's 7.2%.

Contributing Factors:

Private Consumption: Accounting for 60% of GDP, private consumption grew by 6%, down from 7.4% in the previous quarter. This slowdown is attributed to higher food inflation, elevated borrowing costs, and stagnant wage growth, which have dampened urban spending despite a recovery in rural demand.

Government Expenditure: Real-term government spending increased by 4.4% year-on-year, recovering from a 0.2% contraction in the prior quarter, indicating a resurgence in public sector investment.

Germany’s number of unemployed individuals reached 2.86 million

11/29/2024 3:00 pm EST

AJ Economy Trend - Europe Down

In November 2024, Germany's unemployment figures presented a mixed picture:

Unemployment Figures: The number of unemployed individuals increased by 7,000, reaching a total of 2.86 million. This rise was significantly below the anticipated increase of 20,000, indicating a less severe impact than expected.

Unemployment Rate: The seasonally adjusted unemployment rate remained steady at 6.1%, unchanged from October. This stability suggests that, despite economic challenges, the labor market has not deteriorated further in terms of unemployment rate.

Job Vacancies: The demand for labor showed signs of weakening, with job openings declining to 668,000—a decrease of 65,000 compared to the same period last year. This reduction reflects a cautious approach by employers amid ongoing economic uncertainties.

These developments occur against a backdrop of economic challenges, including a slowdown in key industries and concerns about future employment prospects. Notably, the manufacturing sector is experiencing increased short-time work and job cuts as it navigates the current economic climate.

Japan’s Consumer Confidence Index increased slightly due to decline in employment sentiment in November 2024

11/29/2024 1:00 pm EST

AJ Economy Trend - Asia Down Mix Due to Decline in Employment Sentiment

Japan's Consumer Confidence Index (CCI) increased to 36.4 in November 2024 from October's 36.2, aligning with market forecasts. This uptick reflects improved household sentiment in several areas:

Income growth: rose to 40.2 from 39.4 in October.

Willingness to buy durable goods: edged up to 29.9 from 29.7.

Overall livelihood: slightly increased to 34.3 from 34.2.

Sentiment regarding employment declined to 41.0 from 41.6. These figures suggest a modest recovery in consumer confidence, with notable gains in income expectations and purchasing intentions, despite concerns about employment prospects.

source: Trading Economics, Cabinet of Japan

Germany’s unemployment rate unchanged at 6.1% compare to previous month

11/29/2024 1:00 pm EST

AJ Economy Trend - Europe Down

As of November 2024, Germany's seasonally adjusted unemployment rate stands at 6.1%, unchanged from the previous month. The number of unemployed individuals increased by 7,000, bringing the total to approximately 2.86 million.

This rise in unemployment is less than the 20,000 increase anticipated by analysts, indicating a slightly more resilient labor market than expected. However, economic challenges persist, with job vacancies declining to 668,000—a decrease of 65,000 compared to the same period last year.

Economists forecast that Germany's economy will underperform among the G7 nations for the second consecutive year, with further increases in unemployment anticipated in 2025. Factors such as a shortage of skilled workers and weak labor productivity are contributing to these challenges. Additionally, companies are exhibiting caution in their hiring plans, as reflected in a slight drop in the Ifo employment barometer.

In the manufacturing sector, some companies are implementing short-time work and job cuts to navigate the current economic downturn. Overall, the labor market is beginning to feel the strain of these economic challenges, which may also negatively impact consumer sentiment.

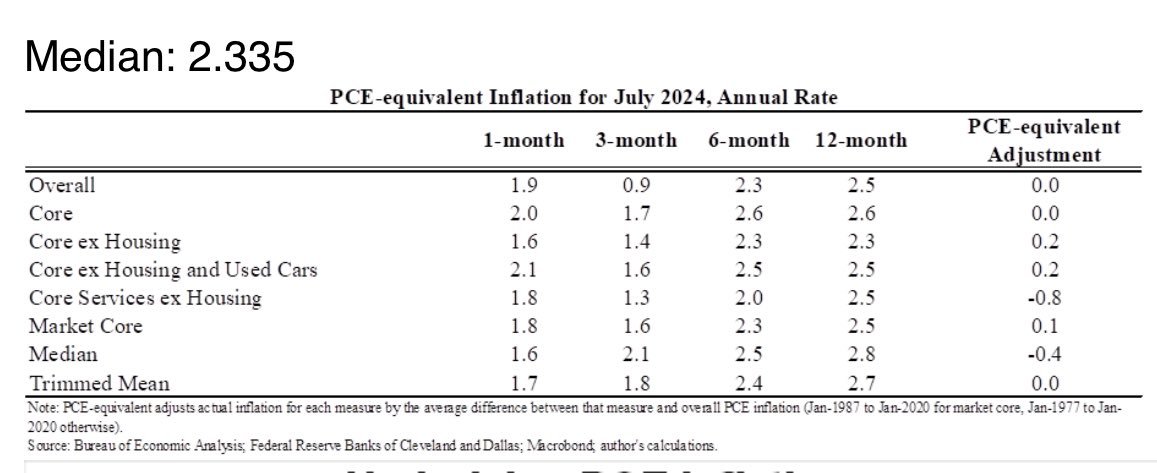

Core PCE Price Index reported at 2.8% with slowed down increase but still above Fed’s Target

11/27/2024 1:00 pm EST

AJ Economy Trend - US Down

In October 2024, the PCE Price Index increased by 0.2% from the previous month, maintaining the same pace as in September. On a year-over-year basis, the index rose by 2.3%, up from 2.1% in September. The core PCE Price Index, which excludes food and energy, rose by 0.3% month-over-month and 2.8% year-over-year, slightly higher than September's 2.7%.

These figures indicate that while inflation remains above the Federal Reserve's target, the increases are modest. The Fed considers such data when making decisions about interest rates and other monetary policies to achieve its dual mandate of stable prices and maximum employment.

France’s consumer index fell to 90 from 93 in October, reflecting growing concerns on rising unemployment

11/27/2024 10:00 am EST

AJ Economy Trend - Europe Down

In November 2024, France's consumer confidence index fell to 90, down from a revised 93 in October, marking the lowest level in five months. This decline reflects growing concerns among households about rising unemployment and the country's economic outlook.

The index, compiled by the National Institute of Statistics and Economic Studies (INSEE), is based on a survey of approximately 2,000 households, assessing their perspectives on personal financial situations, economic conditions, unemployment, and intentions regarding major purchases and savings. A value above 100 indicates optimism, while below 100 signifies pessimism.

In November, several components of the index deteriorated:

Future Financial Situation: The balance of opinion fell to -13 from -8 in October, indicating increased pessimism about personal financial prospects.

Unemployment Concerns: The proportion of households fearing a rise in unemployment increased, with the corresponding balance climbing to 42 from 33.

Major Purchases: The index measuring the suitability of making major purchases slightly declined to -30 from -29, suggesting reduced consumer spending intentions.

These figures underscore the challenges facing the French economy, as consumer confidence is a key indicator of household spending, which significantly influences economic growth. The decline suggests potential headwinds for domestic demand in the near term.

For more detailed information, refer to INSEE's official publications.

The U.S. economy expanded at an annualized rate of 2.8% in the third quarter of 2024

11/27/2024 11:00 am EST

AJ Economy Trend - US Neutral

The U.S. economy expanded at an annualized rate of 2.8% in the third quarter of 2024, consistent with the advance estimate and slightly below the 3.0% growth observed in the second quarter. This growth was primarily driven by robust consumer spending, which increased by 3.5%, marking the fastest pace since the first quarter of 2023. However, this figure was revised down from the initial estimate of 3.7%. The surge in consumer spending was led by a 5.6% increase in goods consumption, down from the previously reported 6%, while spending on services remained steady at 2.6%.

Government consumption expenditures and gross investment grew by 5%, unchanged from the advance estimate, reflecting continued public sector support to the economy. Net trade contributed negatively to GDP growth, with a slightly larger drag of 0.57 percentage points compared to the initial estimate of 0.56 percentage points. This was due to downward revisions in both exports, which grew by 7.5% (initially 8.9%), and imports, which increased by 10.2% (initially 11.2%).

Private inventory investment subtracted 0.11 percentage points from GDP growth, an improvement from the 0.17 percentage point reduction reported in the advance estimate, indicating a smaller-than-expected drawdown in inventories. Fixed investment rose by 1.7%, exceeding the earlier estimate of 1.3%. Within this category, equipment investment surged by 10.6%, slightly below the initial 11.1% estimate. Conversely, investment in structures declined by 4.7% (initially -4%), and residential investment decreased by 5% (initially -5.1%), highlighting ongoing challenges in the construction and housing sectors.

Chicago Purchasing Manager’s Index down to 41.6 from 46.6 in September

11/27/2024 10:00 am EST

AJ Economy Trend - US Down

The Chicago Purchasing Managers' Index (PMI), also known as the Chicago Business Barometer™, is a key indicator of economic activity in the Chicago region, encompassing both manufacturing and non-manufacturing sectors. Compiled by the Institute for Supply Management-Chicago (ISM-Chicago) and MNI Indicators, the index is derived from five weighted components: Production (25%), New Orders (35%), Order Backlogs (15%), Employment (10%), and Supplier Deliveries (15%). A PMI reading above 50 signifies expansion, while a reading below 50 indicates contraction.

In October 2024, the Chicago PMI declined to 41.6 from 46.6 in September, marking the lowest level since May 2024. This downturn reflects a contraction in the region's economic activity for the 11th consecutive month, with significant decreases in Production, New Orders, Order Backlogs, and Employment.

Source: Chicago Business Barometer

Initial Jobless Claims at 213,000 compared to 215,000 revised number from previous week

11/26/2024 10:00 am EST

AJ Economy Trend - US Down Mix due to rising continuous claims

Initial Unemployment Claims

Latest Data: Seasonally adjusted initial claims for the week ending November 23 were 213,000, a decrease of 2,000 from the previous week's revised level.

Revision Details: The previous week's level was revised up by 2,000 (from 213,000 to 215,000).

4-week Moving Average: It decreased by 1,250 to 217,000, indicating a smoother downward trend.

The previous week's average was revised up by 500 (from 217,750 to 218,250).

Insured Unemployment (Continuing Claims)

Insured Unemployment Rate: Unchanged at 1.3% for the week ending November 16.

Insured Unemployment Numbers: Increased by 9,000 to 1,907,000, marking the highest level since November 13, 2021.

The previous week's figure was revised down by 10,000 (from 1,908,000 to 1,898,000).

4-week Moving Average: Rose by 13,500 to 1,890,250, the highest since November 27, 2021.

The previous week's average was revised down by 2,500 (from 1,879,250 to 1,876,750).

France Manufacturing And Services PMI remained in contraction in October 2024

11/22/2024 10:00 am EST

AJ Economy Trend - Europe Down

In November 2024, France's manufacturing sector experienced a further decline, with the HCOB France Manufacturing PMI dropping to 43.2 from 44.5 in October, indicating a more pronounced contraction than anticipated. This decline marks the 22nd consecutive month of shrinking manufacturing activity, the most severe since January. The downturn was particularly acute in the automotive, construction, and cosmetics industries, where factory orders diminished both domestically and abroad. Despite the faltering demand, there was a notable increase in input prices, contrasting with a decrease in output prices. This imbalance has led to continued workforce reductions within factories. Firms also reported a persistent negative outlook, suggesting ongoing challenges for the sector.

The French services sector experienced a significant contraction in November 2024, with the HCOB France Services PMI dropping to 45.7, down from 49.2 in October and falling below expectations of 49. This marked the most substantial contraction since January, attributed to political and economic uncertainties that curtailed client spending. New orders declined sharply, leading businesses to focus more on clearing backlogs, which in turn resulted in the most pronounced reduction in outstanding business volumes in four years. Despite these challenges, employment in the sector increased, witnessing the strongest hiring rate in six months. Cost pressures also intensified, with input prices reaching a three-month high, causing service providers to raise their output charges. Looking forward, growth expectations have turned pessimistic for the first time since May 2020, driven by enduring weak demand.

HCOB France Services PMI

HCOB France Manufacturing PMI

Germany’s Economy Continued To Contract with -0.3% Contraction

11/21/2024 10:00 am EST

AJ Economy Trend - Europe Down

Germany's economy continued its downward trend with a 0.3% contraction in gross domestic product (GDP) year-on-year for the third quarter of 2024. This contraction matches the decline in the previous quarter and is slightly worse than initial estimates, which forecasted a 0.2% drop. This marks the fifth consecutive quarter that the German economy has contracted, underscoring persistent economic challenges.

S&P Service Sector Index PMI increased to 57 but Manufacturing PMI continues to struggle with contraction at 48.8

11/21/2024 10:00 am EST

AJ Economy Trend - US Down Mix

In November, the U.S. economy accelerated, driven by optimism regarding potential interest rate cuts by the Federal Reserve and favorable policies expected from a pro-business Trump administration. The S&P U.S. service sector index surged to a 32-month high of 57.0, up from 55.0 the previous month, indicating strong growth especially since readings above 55 are considered exceptional. This growth in the service sector, which employs the majority of Americans and includes industries like banking, retail, and restaurants, has been a pivotal force in driving the post-pandemic economic expansion.

Conversely, the manufacturing sector continues to struggle, with the "flash" U.S. manufacturing PMI remaining in contraction at 48.8, showing little change from prior assessments. Manufacturing constitutes a smaller portion of the economy today compared to services.

Key developments in November included a sharp rise in new orders, reaching a two-year high, and a slight cooling in inflation rates. However, employment in the sector fell for the fourth consecutive month, though there are signs of optimism and potential hiring increases in the manufacturing sector, suggesting a more broad-based economic upturn in the near future.

Economic Leading Indicator shows 12 months continuous decline in October 2024

11/21/2024 10:00 am EST

AJ Economy Trend - US Down Mix

In October, the leading indicators for the U.S. economy declined for the eighth consecutive month, decreasing by 0.3% as reported by the Conference Board. This decline was primarily driven by an increase in jobless claims, a reduction in building permits, and a decrease in manufacturing orders. Despite this persistent downward trend in the leading index, which has been occurring almost monthly since early 2022, the overall economy has maintained robust growth.

Initial Jobless Claim decreased 6,000 to 213,000 with revised count of 219,000 from previous week’s claim.

11/21/2024 10:00 am EST

AJ Economy Trend - US Up Mix due to revision

Last week, U.S. jobless claims fell to a seven-month low, reflecting the economy's steady growth and ongoing demand for a full workforce. The latest figures show a decrease of 6,000 applications, with new claims settling at 213,000, down from a revised count of 219,000 the previous week. This decline occurred in 37 out of the 53 states and territories that contribute data.

Despite the drop in new claims, there is a concerning rise in continuing claims, which have now exceeded 1.9 million for the first time since early 2018, excluding the pandemic months. This increase suggests that individuals are finding it more challenging to secure new employment after job loss, pointing to potential underlying issues in the labor market.

October Retail Sales rose 0.4%, beating expectations and September’s figure revised up to 1.2% gain.

11/15/2024 10:00 am EST

AJ Economy Trend - US Up Mix possible personal debt increase with consumption

On Friday, November 15, 2024, the Commerce Department reported that October retail sales increased by 0.4% from September, surpassing economists' expectations of a 0.3% rise. Additionally, September's sales growth was revised upward to 0.8%, doubling the initial estimate. However, when excluding food and gasoline, sales in October rose by just 0.1%, below the anticipated 0.4% increase, though September's figures were also revised up to a 1.2% gain from 0.7%.

Despite these positive retail figures, Federal Reserve Chairman Jerome Powell indicated that policymakers are in "no hurry" to cut interest rates, citing ongoing economic growth, a solid job market, and inflation above the 2% target.

This cautious stance contributed to a decline in the stock market, with the S&P 500 falling 1.3% on Friday, extending its weekly losses.

Initial Jobless Claims down 4,000 from prior week and insured unemployment dropped to 1,873,000

11/15/2024 10:00 am EST

AJ Economy Trend - US Up

In the latest report for the week ending November 9, U.S. initial jobless claims saw a decrease of 4,000, reaching 217,000 from the prior week's level of 221,000, which was not revised. The four-week moving average also fell by 6,250 to 221,000 from the previous average of 227,250, indicating a slight improvement in jobless claims trends.

The insured unemployment rate remained steady at 1.2 percent as of the week ending November 2, with no change from the previous week. The number of people receiving benefits, known as the insured unemployed, dropped by 11,000 to 1,873,000 from the previous week’s revised figure. The previous week's numbers themselves were adjusted downward by 8,000 from 1,892,000 to 1,884,000.

The four-week moving average of the insured unemployed slightly increased by 1,000, reaching 1,874,500, which marks the highest level for this average since November 27, 2021, when it stood at 1,928,000. This revision adjusts the prior week’s average down from 1,875,500 to 1,873,500. This data suggests a mixed outlook with a general stability in the insured unemployment rate but a slight increase in the average number of claims.

Producer Price index at 2.4%, Core PPI at 3.5% in October PPI Report

11/14/2024 10:00 am EST

In October, the Producer Price Index (PPI) for final demand increased by 0.2 percent, marking a continuation of the trend observed over the past few months, with a 0.1 percent rise in September and a 0.2 percent increase in August. Annually, the index rose by 2.4 percent, unadjusted.

The majority of the increase in October was attributed to the services sector, where the PPI for final demand services rose by 0.3 percent. This was mainly driven by a similar 0.3 percent increase in prices for services excluding trade, transportation, and warehousing. Additionally, there was a 0.5 percent increase in transportation and warehousing services and a slight 0.1 percent rise in trade services.

Significant contributors to the rise in service prices included a notable 3.6 percent increase in portfolio management fees. Other areas seeing price increases were machinery and vehicle wholesaling, airline passenger services, computer and software retailing, outpatient care, and cable and satellite services. However, there were declines in apparel retailing and freight trucking, which fell by 3.7 percent and in securities brokerage and investment advice services.

For final demand goods, there was a modest 0.1 percent increase, following two months of decline. This was primarily due to a 0.3 percent rise in the index for goods excluding food and energy. On the contrary, energy prices fell by 0.3 percent and food prices by 0.2 percent.

Significant movements in goods prices included an 8.4 percent jump in carbon steel scrap and increases in meats, diesel fuel, vegetables, and oilseeds. Conversely, liquefied petroleum gas prices plummeted by 18.1 percent, and there were decreases in chicken eggs, processed poultry, and ethanol prices.

Overall, the data for October suggests a mild upward pressure in producer prices, particularly in services excluding more volatile sectors like trade and transportation, with an ongoing modest rise in the core index of final demand less foods, energy, and trade services, which increased by 3.5 percent over the past twelve months.

Consumer Price index at 2.6%, Core CPI at 3.3% in October CPI Report

11/14/2024 09:00 am EST

In October, the Consumer Price Index for All Urban Consumers (CPI-U) saw a 0.2 percent rise, maintaining the same monthly increase pattern observed over the previous three months. Annually, the index escalated by 2.6 percent without seasonal adjustments.

The shelter index was a significant contributor to October's inflation, increasing by 0.4 percent and accounting for more than half of the overall monthly rise in the CPI. Food prices also edged higher, with a 0.2 percent increase; specifically, the index for food consumed at home went up by 0.1 percent, and the index for food consumed away from home rose by 0.2 percent. Energy prices remained steady during the month, following a 1.9 percent decline in September.

Excluding food and energy, the core CPI increased by 0.3 percent, mirroring rises seen in August and September. Notable increases in this category were observed in shelter, used cars and trucks, airline fares, medical care, and recreation, while prices for apparel, communication, and household furnishings and operations dipped.

Looking at the year-over-year metrics, the all items index has gone up by 2.6 percent, an acceleration from the 2.4 percent increase recorded in the preceding year. The core index, excluding food and energy, saw a 3.3 percent rise over the past 12 months. Energy prices showed a significant annual decline of 4.9 percent, whereas food prices modestly increased by 2.1 percent over the same period.

United Kingdom’s unemployment rate increased to 4.3%, surpassing anticipated level of 4.1%

11/11/2024 12:00 pm EST

The United Kingdom's unemployment rate increased to 4.3% between July and September 2024, up from 4% in the previous quarter, surpassing the anticipated 4.1%. This rise marks the highest level since the three months ending in May 2024. The uptick is primarily attributed to an increase in individuals unemployed for up to six months, while those unemployed for over six months also rose during this period.

Despite the rise in unemployment, the number of employed individuals grew by 220,000 to 33.31 million, driven mainly by year-over-year growth in full-time employment. Conversely, the proportion of people holding second jobs declined, now representing 3.7% of all employed individuals. The economic inactivity rate remained steady at 21.8%, unchanged from the previous period.

These figures suggest a complex labor market scenario, with simultaneous increases in employment and unemployment rates. The rise in unemployment, particularly among those unemployed for up to six months, may indicate emerging challenges in the job market.

It's important to note that recent data collection challenges have introduced increased volatility in labor market estimates. The Office for National Statistics advises caution when interpreting short-term changes and recommends considering these figures alongside other labor market indicators for a comprehensive understanding.

Buffet Indicator shows 208% overvalue from the size of the current US economy

11/08/2024 12:00 pm EST

The Buffett Indicator, at its current value of 208%, is a crucial tool for evaluating stock market valuations relative to the size of the US economy. This figure, well above its historical average, signals that the market may be significantly overvalued, posing risks of a potential market correction. The Indicator's emphasis on total market value versus GDP helps highlight when the market's valuation may be disconnected from economic fundamentals.

Key aspects of the Buffett Indicator include:

Comparative Market Valuation: The ratio gives investors an overarching sense of how current stock market valuations measure up against economic productivity, identifying potential bubbles when valuations surge relative to GDP.

Interest Rate Impact: High or low interest rates play a pivotal role in influencing this ratio. Low rates often lead to higher stock prices as investors seek better returns than those offered by bonds, potentially inflating the ratio. Conversely, high rates can suppress stock valuations.

Global Sales Influence: Modern globalization means that US-based companies often derive substantial revenues from international markets. This revenue inflates the stock market value relative to domestic GDP, complicating direct comparisons between the two figures.

Cyclical Behavior and Trends: Historical deviations from the trend, such as those during the dot-com bubble, show that extreme overvaluations can persist before correcting. The current value, at 2.2 standard deviations above the trend, implies a strong likelihood of overvaluation based on historical precedent.

Why It Matters: When the stock market valuation significantly outpaces GDP growth, it can indicate unsustainable conditions fueled by investor optimism, low interest rates, or speculative behavior. Understanding this ratio helps investors, analysts, and policymakers assess whether the market is rationally priced or potentially vulnerable to correction.

Source: https://www.currentmarketvaluation.com/models/buffett-indicator.php

Federal Reserve lowered Fed Fund Rates by 25bps

11/08/2024 12:00 pm EST

On November 7, 2024, the Federal Reserve reduced its benchmark interest rate by 0.25 percentage points, bringing it to a range of 4.5% to 4.75%. This decision follows a larger 0.5 percentage point cut in September, marking the first rate reductions since 2020.

The Federal Reserve's actions aim to support economic growth amid signs of a cooling labor market and inflation nearing the central bank's 2% target. In September, the core personal consumption expenditures (PCE) price index, which excludes food and energy prices, increased by 2.7% from the previous year, slightly above expectations.

Despite these rate cuts, the U.S. economy has shown resilience, with a 2.8% GDP growth in the third quarter and a slight decrease in unemployment to 4.1%.

However, the Federal Reserve remains cautious, indicating that future rate decisions will depend on ongoing economic assessments.

Initial Jobless Claims climbed to 218,000 and continuous unemployment is highest since November 2021

11/07/2024 12:00 pm EST

Initial Unemployment Claims:

For the week ending November 2: 221,000 new claims were filed, up by 3,000 from the revised figure of 218,000 from the prior week.

4-week moving average: Decreased by 9,750 to 227,250, suggesting a stabilization or slight decline in the trend.

Insured Unemployment:

Insured unemployment rate: Remained at 1.2% for the week ending October 26.

Number of people receiving unemployment benefits: Increased to 1,892,000, up by 39,000 from the previous week, marking the highest since November 2021.

4-week moving average for insured unemployment: Increased by 8,500 to 1,875,500, also the highest since late November 2021.

October 2024 US unemployment unchanged at 4.1% but with massive downward revisions of employment from previous months

11/01/2024 12:00 pm EST

The October 2024 U.S. employment report released by the Bureau of Labor Statistics indicates minimal changes in the labor market. Total nonfarm payroll employment showed a negligible increase of 12,000 jobs, maintaining the unemployment rate at 4.1%. This steady state reflects ongoing trends with slight gains in sectors like healthcare and government, contrasted by losses in temporary help services and a notable decline in manufacturing due to strikes. The report also highlights the effects of Hurricanes Helene and Milton, which caused significant disruptions in the southeast U.S., potentially influencing the job market data.

Household survey data reveal consistent unemployment rates across various demographic groups with no significant changes in the number of unemployed, remaining around 7.0 million. Long-term unemployment figures are slightly higher than the previous year, reflecting persistent challenges in the labor market. Labor force participation and employment-population ratios remained stable, indicating little overall movement in workforce engagement.

In industry specifics, health care continued to add jobs, aligning with its year-long growth trend, while government employment also rose. Conversely, the manufacturing sector suffered job losses primarily due to strike actions, impacting overall employment figures in this sector. The report also detailed adjustments in employment data for previous months, showing downward revisions that suggest less growth than initially reported.

The revisions to the total nonfarm payroll employment figures for August and September indicate significant downward adjustments. Originally reported gains for August were decreased from 159,000 to 78,000, and for September from 254,000 to 223,000. These adjustments have resulted in a combined reduction of 112,000 jobs for these two months compared to previous reports. These changes are attributed to additional data received from businesses and government agencies, as well as the recalibration of seasonal factors, which are routine processes in refining employment estimates.

As the economic landscape continues to evolve, these employment figures provide a critical insight into the ongoing recovery and adjustments within the U.S. labor market, signaling cautious watchfulness from policymakers, particularly in anticipation of potential rate adjustments by the Federal Reserve in response to economic conditions.

Initial Jobless Claims at 216,000, lowest level since May 2024

10/31/2024 11:30 am EST

The U.S. Department of Labor reported that initial jobless claims decreased by 12,000 to 216,000 for the week ending October 26, 2024, marking the lowest level since May. This decline suggests a rather resilient labor market, as the number of Americans filing new applications for unemployment benefits fell for the third consecutive week. The four-week moving average of initial claims, which smooths out weekly volatility, decreased by 2,250 to 236,500. This trend indicates a steady labor market, with businesses managing labor costs through reduced hiring rather than layoffs.

Continuing jobless claims, representing the number of people receiving benefits after an initial week of aid, fell by 26,000 to 1.86 million for the week ending October 19. This decrease suggests that those who had been receiving unemployment benefits are finding new employment opportunities.

PCE inflation at smallest year over year increase since 2021 at 2.1% annually

10/31/2024 11:00 am EST

In September, U.S. inflation continued edging closer to the Federal Reserve's 2% target, with the personal consumption expenditures (PCE) price index rising 0.2% monthly and 2.1% annually—the smallest year-over-year increase since early 2021. Core PCE inflation, excluding food and energy, increased by 0.3% monthly, steadying at 2.7% annually. Energy prices dropped 2% in September, aiding in lowering overall inflation, though core inflation remains elevated due to persistent service costs, which rose 3.7% over the year.

Personal income grew by 0.3% in September, with consumer spending up 0.5% and the personal saving rate down to 4.6%. Given these trends, the Fed is likely to announce a 0.25% rate cut in November, following a prior half-point cut in September, though core inflation remains a point of concern for the central bank's policy considerations.

US Q3 2024 GDP 2.8% while personal income and savings dropped from Q2 2024

10/30/2024 10:00 am EST

The U.S. economy grew at an annualized rate of 2.8% in Q3, slightly below the anticipated 3% growth rate, according to the Commerce Department's advance estimate. Consumer spending, a key economic driver, rose by 3.7%, up from 2.8% in Q2, highlighting strong domestic demand. However, business investment was tepid, with a 0.3% increase, while private inventory investment and residential fixed investment showed declines.

Personal income rose by $221.3 billion, down from $315.7 billion in Q2, with disposable income increasing by 3.1% and personal savings slightly down to $1.04 trillion.

The personal savings rate also decreased from 5.2% in Q2 to 4.8% in Q3.

ADP Job Creation increased to 233,000 mainly on education and health, utilities and hospitality job

10/30/2024 10:00 am EST

In October, ADP reported a strong increase in private job creation, with 233,000 jobs added—the highest monthly gain since July 2023. This figure far exceeded the expected 113,000 and came despite challenges from hurricanes in the Southeast and significant labor disruptions, such as the Boeing strike. Gains were widespread, led by education and health services (+53,000), trade, transportation, and utilities (+51,000), and leisure and hospitality (+37,000), while manufacturing saw a decline of 19,000 jobs due to the strike. Large companies (500+ employees) accounted for most of the growth, adding 140,000 jobs. The ADP report precedes the Bureau of Labor Statistics’ upcoming nonfarm payroll report, which is expected to show more conservative growth.

U.S. Job Openings decreased significantly by 418,000 to 7.4 million, lowest level since 2021

10/29/2024 10:00 am EST

In September, U.S. job openings decreased significantly, dropping by 418,000 to 7.443 million, marking the lowest level since January 2021. This reduction was largely concentrated in the South, attributed to the impacts of Hurricanes Helene and Milton. California experienced large decrease by 30% and it is the second worst state behind Nevada. Despite the decline in job vacancies, consumer confidence rose sharply in October to a nine-month high, indicating improved public sentiment towards the jobs market. This increase in consumer confidence contrasts with the notable drop in job openings, suggesting that the decrease may not reflect broader economic weaknesses. Additionally, the labor market dynamics included a rise in hires and layoffs during the month, with particular fluctuations influenced by the hurricanes and ongoing strikes in the aerospace sector. The broader economic landscape also saw a significant widening of the goods trade deficit by 14.9% to $108.2 billion, driven by a surge in imports, which predominantly accumulated as retailer inventories, potentially moderating the impact on GDP growth.

S&P Global Flash Services PMI at 55.3 showing resilience with strong domestic demand driving growth

10/24/2024 10:00 am EST

The S&P Global US Services PMI increased slightly to 55.3 in October 2024, up from 55.2 in September, continuing its trend of strong growth and exceeding market expectations of 55.

Overall PMI: The index remains well above the 50-mark, indicating strong expansion in the US services sector for the fifth consecutive month.

New Orders: Experienced the sharpest growth since April 2022, driven by robust domestic demand. However, new export business growth slowed, indicating weakness in international markets.

Employment: There was a decline in headcounts among service providers, but this was primarily due to non-replacement of workers leaving the sector rather than active layoffs, suggesting companies are managing workforce levels conservatively.

Pricing and Inflation: Selling price inflation cooled to its lowest level in over four years, which signals easing cost pressures for consumers. However, input costs, particularly due to wage pressures, continued to rise at a notable rate.

Outlook and Sentiment: Business optimism for the future hit a 16-month high, reflecting confidence in continued demand growth, though there remains some uncertainty tied to the upcoming presidential election.

The services sector continues to show resilience with strong domestic demand driving growth. While inflation pressures on selling prices have eased, input costs remain elevated due to wage pressures. Despite these challenges, businesses are optimistic about the future, supported by robust demand, though the political landscape could introduce some uncertainty.

S&P Global Flash Manufacturing PMI rose but still in contraction territory

10/24/2024 10:00 am EST

The S&P Global Flash US Manufacturing PMI rose slightly to 47.8 in October 2024 from 47.3 in September, reflecting a continued contraction in the US manufacturing sector, though at a slower pace.

Overall PMI: The index remains below 50, signaling a contraction, but the October reading shows the slowest rate of decline since August.

New Orders: Fell for the fourth straight month, although the rate of decline moderated from the sharp drop seen in September. Weak demand continues to pressure manufacturers.

Stocks of Purchases: Decreased at the fastest rate in 14 months, indicating businesses are reducing their inventories amid lower demand.

Production and Employment: Both declined, but the rates of decline have eased compared to previous months.

Supply Chain: For the first time in three months, longer lead-times were reported due to freight-related congestion and weather disruptions.

Inflation Pressures: Selling price inflation eased, and input cost growth dropped to a seven-month low, supported by lower fuel prices and increased competition among suppliers.

While the manufacturing sector is still facing challenges, especially with demand for new orders remaining weak, the easing rates of decline in production, employment, and cost pressures may provide some optimism. However, persistent issues like supply chain disruptions and demand shortfalls continue to weigh on the sector’s recovery.

Initial Jobless Claims decreased by 15,000 WoW, continuous unemployment claims highest since Nov 2021

10/24/2024 10:00 am EST

In the week ending October 19, 2024, the initial claims for unemployment insurance showed a notable decrease, while the insured unemployment rate rose slightly. Here are the key details:

Initial Claims:

Initial claims (seasonally adjusted): 227,000, which is a decrease of 15,000 from the previous week's revised level of 242,000.

4-week moving average: 238,500, an increase of 2,000 from the previous week's revised average of 236,500.

Insured Unemployment Rate and Claims:

Insured unemployment rate: 1.3% for the week ending October 12, an increase of 0.1 percentage points from the prior week.

Insured unemployment claims: 1,897,000, an increase of 28,000 from the previous week's revised level of 1,869,000. This is the highest level of insured unemployment since November 2021.

4-week moving average for insured unemployment: 1,860,750, an increase of 17,500 from the previous week's revised average of 1,843,250.

Overview:

Initial unemployment claims decreased, suggesting fewer new claims for unemployment benefits, which may signal a stabilizing labor market.

However, the increase in insured unemployment, or continuing claims, and the higher insured unemployment rate indicate that more people remain on unemployment benefits, marking the highest level in almost three years.

Federal Reserve Beige Book showing slow growth and declining economic activities in most regions

10/23/2024 12:00 pm EST

Overall Economic Activity:

General Activity: Economic activity remained mostly unchanged, with two districts reporting modest growth. Manufacturing activity was generally in decline, while the banking sector showed steady or slightly improving conditions due to lower interest rates. Consumer spending varied, with more focus on less expensive alternatives.

Housing Market: Home values were stable or rising slightly across most districts, though high mortgage rates kept some buyers on the sidelines. Affordable housing shortages were persistent.

Commercial Real Estate: Activity was largely flat, except for improvements driven by data center and infrastructure projects.

Agriculture and Energy: Agricultural and energy activity showed little change, with energy producers facing lower margins due to declining prices.

Labor Markets:

Employment: Job growth was modest, with hiring mainly for replacement rather than expansion. Worker availability improved, but certain industries (like technology, manufacturing, and construction) still struggled to find skilled workers. Wages continued to rise at a modest to moderate pace, with some slowing due to better worker availability.

Turnover and Layoffs: Worker turnover remained low, and layoffs were limited.

Prices:

Inflation: Inflationary pressures moderated, with selling prices increasing slightly to modestly. Home prices increased in many districts, while rents remained steady or slightly decreased. Firms experienced rising input costs, especially in insurance and healthcare, compressing profit margins.

Regional Highlights:

Boston: Flat economic activity, with price increases and international travel supporting the local economy.

New York: Modest economic growth with steady housing market conditions and strong capital investment plans.

Philadelphia: Slight declines in activity, with expectations of future growth.

Richmond: Modest economic growth, with hurricanes impacting some areas.

Atlanta: Declines in economic activity, particularly in tourism, housing, and manufacturing.

Chicago: Slight economic growth, with modest increases in consumer spending and employment.

St. Louis and Minneapolis: Steady or slightly declining activity, but some signs of optimism for the future.

Dallas: Modest growth driven by nonfinancial services, while manufacturing and retail sales weakened.

San Francisco: Stable economic conditions, with improvements in labor availability and stable prices.

While economic growth was slow or flat in most regions, there was some optimism for improvement, tempered by concerns about inflation, high mortgage rates, and uncertainty in the labor market.

Conference Board’s Leading Economic Index for U.S. fell by 0.5% in September 2024

10/21/2024 5:00 pm EST

The Conference Board's Leading Economic Index® (LEI) for the U.S. fell by 0.5% in September 2024, marking its second consecutive monthly decline, following a 0.3% drop in August. Over the six-month period from March to September 2024, the LEI dropped by 2.6%, indicating a steeper decline compared to the previous six-month period, which saw a 2.2% decrease.

Several factors contributed to the LEI's continued decline, including a persistent weakness in new factory orders, an inverted yield curve, declining building permits, and a muted outlook for future business conditions from consumers. These negative influences were not sufficiently counterbalanced by gains in other LEI components, signaling ongoing uncertainty in the economy. Justyna Zabinska-La Monica from The Conference Board noted that these factors point to a period of moderate growth through the end of 2024 and into early 2025.

Meanwhile, the Coincident Economic Index® (CEI), which tracks current economic conditions, edged up by 0.1% in September, following a 0.2% rise in August. The CEI has grown by 0.9% over the past six months, with payroll employment, personal income (excluding transfer payments), and manufacturing and trade sales all contributing positively. However, industrial production declined, slightly offsetting these gains.

The Lagging Economic Index® (LAG), which reflects changes after the economy shifts, decreased by 0.3% in September, marking a 0.2% contraction over the last six months. This marks a reversal from the 1.1% growth seen in the previous period.

In conclusion, LEI's continued decline and the LAG's negative shift indicate that economic conditions remain fragile, with potential headwinds expected as the year closes.

First National Bank of Lindsay seized by FDIC, marking 2nd failure in 2024, 7th failure since Silicon Valley bank in 2023

10/20/2024 5:00 pm EST

The closure of The First National Bank of Lindsay, Oklahoma, by the Office of the Comptroller of the Currency (OCC) marks the second bank failure in the U.S. in 2024, following the closure of Republic First Bank in Philadelphia earlier this year. The FDIC has appointed First Bank & Trust Co. of Duncan, Oklahoma, to assume the insured deposits of the failed bank, ensuring continuity for depositors. The bank's sole branch will reopen under its new ownership on Monday, October 21, 2024, with all insured deposits still covered by the FDIC.

The First National Bank of Lindsay had total assets of $107.8 million as of June 30, 2024, and deposits amounting to $97.5 million, of which $7.1 million exceeded FDIC insurance limits. The FDIC will begin to return 50% of uninsured funds starting Monday, with the possibility of further recoveries as the bank's assets are sold.

The FDIC's Deposit Insurance Fund (DIF) is expected to incur an estimated cost of $43 million due to the bank's failure, which the FDIC attributed to alleged fraud. First Bank & Trust Co. will assume the insured deposits and purchase approximately $20 million of the failed bank's assets, while the FDIC will retain the remaining assets for later disposition.

Customers with deposits exceeding $250,000 are encouraged to contact the FDIC to discuss their insurance coverage and options, and to visit the FDIC website for further information starting Monday. The FDIC has set up a toll-free line and extended hours to assist customers.

Mortgage Rates increased to 3 weeks high at 7% with homebuying activity declined by 7% Weekly

10/20/2024 12:00 pm EST

Mortgage rates in the U.S. rose for the third consecutive week, with the average 30-year fixed-rate mortgage reaching 6.44%, the highest level since August. The increase from 6.32% the previous week has further slowed activity among both homebuyers and refinancers. Similarly, 15-year mortgage rates rose to 5.63% from 5.41%.

These rising rates, reflecting economic strength and market expectations about the Federal Reserve’s future rate cuts, have led to a significant reduction in refinancing activity, which dropped 26% in a week, according to the Mortgage Bankers Association. Homebuying activity also declined by 7% week-over-week, despite rates being over a percentage point lower than last year. Many potential buyers are still cautious, even though purchase applications remain about 7% higher compared to the same period in the previous year.

United Kingdom ‘s inflation fallen below the BOE’s 2% target

10/19/2024 12:00 pm EST

Inflation in the U.K. dropped sharply to 1.7% in September 2024, marking the first time since April 2021 that inflation has fallen below the Bank of England's (BOE) 2% target. This unexpected decrease from 2.2% in August, along with core inflation falling to 3.2%, has increased market expectations for a BOE rate cut in November. Money markets now price a 92% chance of a 25-basis-point cut, with another reduction in December likely, which would lower the BOE's key rate to 4.5%.

This inflation drop is driven by easing price pressures in the services sector, which saw inflation slow from 5.6% in August to 4.9% in September. The pound fell against both the U.S. dollar and the euro following the news, and yields on U.K. government bonds (gilts) dropped as well.

Economists remain cautious, however, noting potential risks, including an increase in the energy price cap in October and the anticipated U.K. budget at the end of the month, which could have inflationary effects.

China’s economy experiencing slowest growth in 18 months

10/19/2024 11:00 am EST

China's economy experienced its slowest growth in 18 months in the third quarter of 2024, expanding by 4.6% year-on-year. Despite recent stimulus measures, optimism has faded as details of a major property sector bailout remain unclear. Weak consumer spending and a prolonged property crisis continue to hamper growth, with September's inflation data pointing to deflation risks. Although authorities have eased home-buying restrictions and announced plans to boost credit for unfinished housing projects, economists believe more direct fiscal stimulus is needed to revive the economy. Investors are waiting for clearer strategies to drive long-term, consumption-driven growth.

Initial Jobless Claim Decreased on October 17th Week But With Continuous Long Term Increase Trend

10/17/2024 11:00 am EST

The unemployment data for the week ending October 12 reveals a decline in initial claims, reflecting a potentially strengthening labor market despite some increases in longer-term metrics:

Initial Claims:

Seasonally adjusted initial claims: 241,000 (down by 19,000 from the previous week).

Previous week's claims were revised up from 258,000 to 260,000.

The 4-week moving average of initial claims rose by 4,750 to 236,250 (from the revised 231,500).

Insured Unemployment (continuing claims):

The seasonally adjusted insured unemployment rate was steady at 1.2%.

The insured unemployment number for the week ending October 5 was 1,867,000, a slight increase of 9,000 from the revised 1,858,000.

The 4-week moving average for insured unemployment increased by 11,500 to 1,842,750 (from the revised 1,831,250).

This suggests that while there was a short-term drop in initial claims, the longer-term metrics such as the insured unemployment and its moving average saw minor increases, signaling a mixed but relatively stable labor market.

China continues to experience deflation pressure in September 2024

10/13/2024 11:00 am EST

China's economic landscape is showing signs of deepening challenges, as the latest data on consumer inflation and producer prices reveal a more sluggish economy than anticipated. In September 2024, China's consumer price index (CPI) rose by only 0.4% year-on-year, falling short of the expected 0.6% increase and marking the slowest pace of inflation in three months. This indicates weak consumer demand, which is concerning for a country aiming to stimulate domestic consumption.

On the production side, the producer price index (PPI) registered a sharper-than-expected decline, falling 2.8% year-on-year, which is a significant drop compared to the 1.8% decline in August. This deepening producer price deflation signals that Chinese companies continue to face falling prices for their goods, which can squeeze profit margins and discourage investment and production.

Germany’s Economic Downturn continues for the 2nd consecutive year

10/12/2024 11:00 am EST

Germany’s economic downturn deepening through 2024 underscores significant structural challenges, especially in manufacturing and global competition, with a particular strain from China. This year, Germany is projected to shrink by 0.2%, marking its second consecutive year of contraction, following a 0.3% decline in 2023. This makes it the only G7 nation facing a recession in 2024.

The German government's 49-measure growth package is crucial to reversing this trend, focusing on investment and productivity improvements. Economy Minister Robert Habeck emphasized that these reforms, alongside falling inflation and wage increases, could pave the way for recovery. Growth is expected to return in 2025, with GDP projected to rise by 1.1%, driven by an upturn in private consumption and stabilizing inflation. By 2026, growth may reach 1.6%.

However, deep-rooted structural challenges persist, including decarbonization, digitalization, demographic shifts, and competition in key industries like automotive and mechanical engineering. The Manufacturing PMI reflects ongoing struggles, with Germany’s September 2024 reading at 40.6, signaling its 27th consecutive month of contraction.

Foreign takeovers and international investments, such as BASF’s new factory in China, highlight the pressure on German firms to seek growth outside of domestic markets. While these moves may bring relief, they underscore the significant restructuring required to address Germany's long-term economic challenges.

University of Michigan’s consumer sentiment index fell to 68.9 in October 2024

10/10/2024 11:00 am EST

In October 2024, the University of Michigan's consumer sentiment index fell to 68.9 from 70.1 the previous month, missing the forecasted 70.8. This decline was seen in both the current conditions index, which dropped slightly from 63.3 to 62.7, and the expectations index, which decreased from 74.4 to 72.9. Notably, inflation expectations for the coming year increased to 2.9% from 2.7%, although the five-year outlook slightly improved, dropping to 3% from 3.1%. According to Joanne Hsu, the Director of Surveys of Consumers, while long-term business conditions saw the highest positivity in six months, consumers continue to be frustrated by high prices, and sentiments around current and expected personal finances have weakened.

Producer Price Index unchanged in September MoM , 1.8% YoY

10/10/2024 10:00 am EST

In September, the Producer Price Index (PPI) for final demand remained unchanged, as reported by the U.S. Bureau of Labor Statistics. This stability follows a modest 0.2 percent increase in August and no change in July. Over the past twelve months, the unadjusted final demand index rose by 1.8 percent.

Breaking it down, the September data revealed a balance between sectors: a 0.2 percent increase in the index for final demand services counteracted a corresponding 0.2 percent decrease in prices for final demand goods. The core index, which excludes food, energy, and trade services, saw a slight increase of 0.1 percent in September, continuing from a 0.2 percent rise in August. Annually, this core index has increased by 3.2 percent.

Delving deeper, the rise in final demand services was broadly supported, with significant contributions from a variety of sectors. Notably, deposit services surged by 3.0 percent. Other areas such as machinery and vehicle wholesaling, furniture retailing, and airline passenger services also saw price increases. In contrast, there was a significant 6.3 percent drop in the margins for professional and commercial equipment wholesaling, alongside declines in securities brokerage and consumer loans.

For final demand goods, the September decline was primarily driven by a sharp 2.7 percent decrease in energy prices, particularly with gasoline prices falling by 5.6 percent. However, there were increases in other areas such as processed poultry, which soared by 8.8 percent, and in the indexes for electric power and motor vehicles, which provided some upward pressure on the goods segment of the index.

Consumer Price Index rose 2.4% YoY and Core CPI 3.3% YoY

10/10/2024 10:00 am EST

The Consumer Price Index for All Urban Consumers (CPI-U) recorded a steady increase of 0.2 percent in September, consistent with the growth observed in August and July, according to the U.S. Bureau of Labor Statistics. Over the past year, the all items index has seen a rise of 2.4 percent before seasonal adjustment.

In September, significant contributors to the monthly increase were the shelter and food indexes, which together accounted for over 75 percent of the rise. Specifically, the food at home index went up by 0.4 percent, and the food away from home index increased by 0.3 percent. Conversely, the energy index experienced a notable decline of 1.9 percent, following a 0.8 percent drop the previous month.

Excluding food and energy, the core index rose by 0.3 percent in September, mirroring the increase seen the prior month. Among the rising indexes were those for shelter, motor vehicle insurance, medical care, apparel, and airline fares, while recreation and communication indexes saw declines.

Year-over-year, the all items index has climbed by 2.4 percent as of September, marking the smallest 12-month increase since February 2021. The core index, excluding food and energy, has increased by 3.3 percent over the past year. The energy index has decreased by 6.8 percent, whereas the food index has grown by 2.3 percent over the same period.

Initial Jobless Claims increased to 258,000 in the week ending October 5th

10/10/2024 10:00 am EST

The latest weekly report on U.S. jobless claims shows a significant increase in initial claims, which rose by 33,000 to reach 258,000 for the week ending October 5. This spike brings initial claims to their highest level since August 5, 2023, matching the previous high of 258,000. The four-week moving average also increased to 231,000, up by 6,750 from the prior week's average.

Despite the jump in initial claims, the insured unemployment rate remained steady at 1.2% for the week ending September 28. However, the total number of people receiving benefits saw an increase, rising by 42,000 to 1,861,000. Additionally, the four-week moving average for insured unemployment rose slightly by 4,500 to 1,832,000, reflecting a modest upward trend in sustained unemployment levels. These figures suggest some growing pressures within the labor market, potentially signaling shifts in employment stability.

NBIR small business optimism remains low in the economy

10/09/2024 11:30 pm EST

The NFIB Small Business Optimism Index for September paints a picture of cautious sentiment among small business owners.

Optimism Remains Below Long-Term Average:

The index rose slightly by 0.3 points to 91.5 in September, but it marks the 33rd consecutive month below the 50-year average of 98. This shows a prolonged period of subdued optimism among small business owners.

Rising Uncertainty:

The Uncertainty Index increased sharply by 11 points to 103, the highest on record, indicating heightened concerns about future business conditions.

Capital Outlays and Inventory:

Capital Outlays: Only 51% of owners reported capital expenditures in the last six months, down five points from August. Planned capital outlays in the next six months also dropped, reflecting hesitation to invest amid economic uncertainty.

Inventory Levels: A net negative 13% of owners reported inventory gains, the lowest reading since June 2020, suggesting a pullback in stocking up on goods. A net negative 3% plan further inventory investment in the coming months.

Challenges in Hiring and Labor Costs:

Job Openings: The share of owners reporting job openings they could not fill fell to 34%, the lowest since January 2021. Of those hiring, 90% reported few or no qualified applicants.

Compensation: While a net 32% of owners reported raising compensation, this was the lowest level since April 2021. Still, 23% plan to raise wages in the next three months.

Financing Costs on the Rise:

The average interest rate on short-maturity loans increased to 10.1%, the highest since February 2001. This rise in borrowing costs may deter further investment and expansion.

Inflation Remains a Primary Concern:

Twenty-three percent of business owners cited inflation as the top problem, with higher input and labor costs continuing to strain profit margins. Price hikes were most prevalent in finance, retail, transportation, and construction sectors.

Profitability and Sales Trends:

Profit trends remained weak, with a net negative 34% of owners reporting lower profits. Weaker sales were the primary factor, though rising costs for materials and labor also contributed. However, the percentage of owners expecting higher real sales volumes improved to a net negative 9%.

Access to Credit and Borrowing Needs:

Credit conditions remain relatively stable, with only 2% of owners indicating that their borrowing needs were not satisfied. A majority (62%) were not interested in obtaining a loan.

While there are slight signs of improvement in optimism, small business owners are clearly grappling with uncertainty, high financing costs, inflation, and labor challenges.

This cautious stance is reflected in reduced capital spending, slower inventory accumulation, and restrained hiring plans.

Consumer credit experienced slower growth than expected

10/09/2024 11:00 pm EST

Credit condition declines in August 2024 report with the following changes from consumers’ sentiment:

Slower Growth in Total Consumer Credit:

Total outstanding consumer credit grew at an annual rate of 2.1% in August, significantly lower than July's 6.3% growth rate and June's 0.8%.

The total consumer credit outstanding reached $5.098 trillion by the end of August.

Revolving vs. Nonrevolving Credit:

Revolving Credit (primarily credit card debt) saw a decrease, contracting at an annual rate of 1.2%. This is notable as it's the largest drop in credit card balances since March 2021.

Nonrevolving Credit (such as auto and student loans) grew at a 3.3% annual rate, which helped offset the decline in revolving credit.

Forecast vs. Actual Growth:

The $8.9 billion increase in consumer credit fell short of forecasts, with economists surveyed by Bloomberg predicting a $12 billion increase, while Seeking Alpha’s consensus was $11.8 billion.

Impact of Credit Card Interest Rates:

The reduction in revolving credit growth aligns with efforts by consumers to manage credit card debt amid record-high interest rates in August, potentially curbing borrowing behaviors.

Unemployment Rate at 4.1%, 235,000 Job added in September

10/04/2024 10:00 pm EST

In September, the U.S. unemployment rate remained steady at 4.1%, with 6.8 million individuals unemployed, showing a slight increase from last year's figures of 3.8% and 6.3 million, respectively. While the unemployment rate for adult men decreased to 3.7%, rates for other major groups such as adult women, teenagers, Whites, Blacks, Asians, and Hispanics saw little change. The number of people unemployed for less than five weeks fell by 322,000 to 2.1 million, but the count of long-term unemployed remained stable at 1.6 million, marking an increase from the previous year.

The labor force participation rate held at 62.7%, and the employment-population ratio was stable at 60.2%. Part-time employment due to economic reasons was consistent at 4.6 million, up from 4.1 million a year earlier, indicating a rise in those unable to find full-time work. About 5.7 million people were out of the labor force but wanted a job, with those marginally attached to the labor force increasing by 204,000 to 1.6 million. Discouraged workers remained about the same at 445,000, reflecting ongoing challenges in the labor market.

Initial Jobless Claims Climbed to 225,000, a slight uptick from 219,000 in previous week

10/04/2024 10:00 pm EST

In the week ending September 28, the U.S. saw a slight uptick in initial jobless claims, with the number rising by 6,000 to 225,000, compared to the previous week's revised figure of 219,000. Despite this week-over-week increase, the four-week moving average of claims, which smooths out some of the weekly volatility, decreased slightly by 750 to 224,250. The insured unemployment rate held steady at 1.2 percent, with the number of insured unemployed dipping marginally by 1,000 to 1,826,000. These figures suggest a generally stable labor market, with minor fluctuations in weekly claims but a small decrease in the average number of claims over the past month.

September manufacturing PMI at 47.2%, signaling continual contraction

10/02/2024 10:00 pm EST

The September Manufacturing PMI® came in at 47.2 percent, indicating a contraction in the manufacturing sector but still pointing to expansion in the overall economy for the 53rd consecutive month since April 2020. Key indices within the PMI report varied:

New Orders Index: Continued in contraction at 46.1 percent, though slightly improved from August's 44.6 percent.

Production Index: Showed improvement, nearing expansion at 49.8 percent, up significantly from 44.8 percent in August.

Prices Index: Entered contraction for the first time this year at 48.3 percent, a substantial drop from 54 percent in the prior month, suggesting decreasing material costs.

Backlog of Orders Index: Slightly improved to 44.1 percent, indicating a continuing reduction in backlogs.

Employment Index: Decreased to 43.9 percent, down from 46 percent, reflecting job cuts or slower hiring in the sector.

The report also noted slower supplier deliveries, a typical sign of increasing demand, with the Supplier Deliveries Index at 52.2 percent. However, the Inventories Index fell sharply to 43.9 percent, indicating lower inventory levels among manufacturers. Additionally, both the New Export Orders and Imports Indexes remained in contraction, reflecting challenges in international trade.

Overall, the data suggests that while the broader economy expands, the manufacturing sector is experiencing a slowdown with lower prices, reduced employment, and contracting new orders and exports. This mixed picture could influence future decisions by policymakers, particularly with regard to interest rates and economic stimulus measures.

Private Companies add 143,000 jobs in September, annual pay increase slowed to 4.7%

10/02/2024 08:00 pm EST

In September, private employers added 143,000 jobs, marking a recovery across most sectors after a period of five months characterized by slower job growth. Notably, the manufacturing sector experienced its first job additions since April, highlighting a positive shift in this area. However, the information sector did not share in this positive trend, as it was the only sector to report job losses during the month. This data signals a potential stabilization or improvement in the labor market, with broad-based gains suggesting resilience in various industries.

The rate of annual pay increases for employees slowed compared to the previous month, according to ADP's data. Job-stayers saw their year-over-year pay gains decrease slightly to 4.7%, while job-changers experienced a more noticeable drop from 7.3% in August to 6.6%.

Pay increases varied by industry sector and firm size:

Goods-producing sectors saw pay gains ranging from 3.6% in natural resources/mining to 5.1% in construction and 4.6% in manufacturing.

Service-providing sectors had variations in pay gains, with education/health services and leisure/hospitality sectors tied at the higher end, each at 5.1%, and information sector reporting lower pay gains at 4.4%.

Firm size also played a role in the median change in annual pay for job-stayers:

Small firms with 1-19 employees had the smallest pay gain at 4.0%, whereas those with 20-49 employees saw a higher increase at 4.6%.

Medium-sized firms showed stronger pay increases, with those employing 50-249 workers seeing a 5.0% rise, and those with 250-499 employees experiencing a 4.8% increase.

Large firms with 500 or more employees reported a pay gain of 4.7%.

These insights suggest a cooling in wage growth across various sectors and firm sizes, reflecting broader economic shifts and potentially influencing future labor market dynamics.

Japanese Nikkei Futures down 4.8% after Shigeru Ishiba winning the leadership

09/29/2024 10:00 pm EST

Immediate market reactions to Shigeru Ishiba winning the leadership of Japan's ruling party, which has implications for monetary policy and market trends:

Yen Strengthening: Following Ishiba's victory, the yen surged by as much as 1.4% against the dollar, a sharp reversal after weakening earlier in the day. The market had previously expected a victory for Ishiba's opponent, Sanae Takaichi, which led to yen depreciation.

Stock and Bond Market Reaction: Japanese stock futures, particularly the Nikkei 225, dropped by 4.8% in after-hours trading following the yen's gains, even though the Nikkei 225 closed higher earlier in the day. The futures market anticipated potential policy shifts under Ishiba that could lead to higher interest rates, a negative factor for stocks. Bond futures slumped as well, reflecting expectations for rising yields.

Political and Monetary Policy Implications: Ishiba, seen as more supportive of a gradual interest rate hike strategy from the Bank of Japan (BOJ), is expected to influence monetary policy. However, the BOJ, under Governor Kazuo Ueda, is cautious about raising rates too quickly. The result also shifts focus to the interest rate gap between Japan and the US, which will affect yen trading in the future.

US consumer confidence dropped in September 2024

09/27/2024 10:00 pm EST

In September 2024, the U.S. Consumer Confidence Index fell sharply to 98.7, down from 105.6 in August, according to The Conference Board. This marked the largest decline since August 2021. The drop was primarily driven by consumers' growing concerns about the labor market, despite the overall job market remaining relatively healthy with low unemployment and stable wages.

The Present Situation Index, which reflects current business and labor market conditions, decreased by 10.3 points to 124.3, indicating a more pessimistic view of the economic environment. Meanwhile, the Expectations Index, reflecting consumers' short-term outlook on income, business, and labor market conditions, dropped 4.6 points to 81.7. Although still above the threshold signaling a recession, this represents a growing unease about the future.

Consumers aged 35 to 54 experienced the steepest confidence decline, making them the least confident group, while those under 35 remained the most optimistic. Confidence fell across most income groups, with individuals earning less than $50,000 seeing the largest drop.

Despite the overall drop, certain areas like home and car buying plans improved slightly on a six-month average basis. While inflation concerns remain significant, average 12-month inflation expectations rose to 5.2%, still below the March 2022 peak of 7.9%. However, the proportion of consumers anticipating higher interest rates continued to decline, while expectations for lower rates increased.

Overall, consumer sentiment is increasingly cautious, with concerns about the labor market, inflation, and economic conditions shaping their outlook for the coming months.

Business Conditions:

18.8% of consumers rated business conditions as "good," down from 21.1% in August.

20.2% of consumers considered business conditions "bad," up from 17.3%.

Labor Market:

30.9% of consumers felt that jobs were "plentiful," down from 32.7%.

18.3% of consumers reported that jobs were "hard to get," an increase from 16.8%.

source: The Confernce Board

Housing Price Growth slowest since November 2023

09/27/2024 10:00 pm EST

The U.S. housing market continues to experience high prices, particularly in the 20 largest metro areas, with the S&P CoreLogic Case-Shiller 20-city house-price index rising by 0.3% in July compared to the previous month. However, the rate of increase has slowed, with home prices rising 5.9% over the past year, down from 6.5% the previous month. This represents the slowest pace of growth for the index since November 2023.

Despite this deceleration, home prices have reached all-time highs, and some cities, like New York, are experiencing significant year-over-year increases (up 8.8%). Conversely, cities like Portland saw much slower growth, with prices rising only 0.8%. On a broader scale, the national home price index rose by 0.2% in July and 5% over the past year.

The report highlights a potential shift toward a buyer’s market, with declining mortgage rates and slowing price appreciation possibly improving housing affordability. The forward path of the housing market remains unknown as sold home prices are starting to see 20% lower than selling home prices. With the increase in unemployment rate and slower hiring rate in the US Labor market, the incentives to purchase a home will not increase without a significant price drop from the seller. It is likely that the housing market is slowly shifting towards buyer’s market in the coming years.

PCE Index shows stability in Year over Year change of 2.2%

09/27/2024 10:00 pm EST

In August, personal income in the U.S. saw a modest increase of $50.5 billion or 0.2%, according to the Bureau of Economic Analysis. Disposable personal income (DPI) also rose by $34.2 billion, matching the increase in personal consumption expenditures (PCE), which went up by $47.2 billion. Both the PCE price index and the core PCE price index, which excludes food and energy, rose by 0.1%.

This period also witnessed a real increase in DPI and PCE by 0.1%, reflecting a slight uptick in services spending by 0.2%, while goods spending remained nearly flat. Year-over-year, the PCE price index grew by 2.2%, with the core index up by 2.7%, indicating sustained price pressures in the economy outside of volatile food and energy costs. The changes in spending habits saw services spending increase by $54.8 billion, particularly in housing and financial services, whereas spending on goods decreased by $7.6 billion, largely due to a drop in new motor vehicle purchases.

Personal saving totaled $1.05 trillion, with the personal saving rate at 4.8%, showing a continued cautious stance by consumers amidst variable economic signals. This economic snapshot highlights the ongoing adjustments in consumer behavior and price dynamics as the U.S. navigates through varying economic conditions.

Initial Jobless Claims dropped slightly to 218,000 from revised number from previous week of 222,000

09/26/2024 09:30 pm EST

In the week ending September 21, initial claims for unemployment benefits totaled 218,000, which was a decrease of 4,000 from the previous week. Notably, the prior week’s figure was revised up by 3,000, from 219,000 to 222,000.

The 4-week moving average, which smooths out weekly volatility, also saw a decrease. It dropped by 3,500 to 224,750, after the previous week's average was revised up slightly by 750 from 227,500 to 228,250.

These adjustments reflect the ongoing refinements and slight improvements in the labor market.

Yield curve shows wider un-inversion as 10 year - 2 year spread widened to 0.25

09/24/2024 09:30 pm EST

This transition from a previously negative spread (inverted curve) to a positive spread has important implications for the economy.

Reversal of Recessionary Signal:

A yield curve inversion is often a signal of an impending recession, as investors expect the central bank (e.g., the Federal Reserve) to cut rates in the future due to slowing economic growth. When the yield curve uninverts, it may indicate that markets believe the worst is behind and economic growth might stabilize, thus alleviating recession fears.

Market Optimism:

The movement into positive territory suggests growing optimism about future economic conditions. Investors may feel that inflation is under control and that central banks will not need to raise rates further, helping improve long-term growth prospects.

Potential Risks:

Despite the uninversion, history shows that recessions can still follow yield curve inversions with a lag. For instance, uninversion occurred before recessions in past cycles, such as before the 2008 financial crisis, meaning that while market sentiment improves, underlying economic pressures could still trigger a recession.

Monetary Policy Implications:

The uninversion may be seen by the Federal Reserve as a sign that their policies are working to curb inflation without overly damaging growth. This could lead the Fed to pause or slow rate hikes in the near future, easing pressure on borrowing costs and stimulating growth.

Credit Conditions:

A positive yield spread can improve credit conditions, as banks typically borrow short-term and lend long-term. As this spread increases, it could encourage more lending, supporting economic activity.

China’s central bank released large stimulus package to re-ignite the Chinese Economy

09/24/2024 12:30 pm EST

China's central bank, the People's Bank of China (PBOC), recently introduced its most significant stimulus package since the pandemic to revive the nation's slowing economy. The broad measures aim to combat deflation and propel growth back towards the government's target of roughly 5%. The stimulus includes reduced borrowing costs, additional liquidity injections, and measures to ease household mortgage burdens.

The stimulus package includes the following policy changes to the Chinese economy:

Lower Reserve Requirement Ratio (RRR): The central bank plans to cut the RRR by 50 basis points, releasing about 1 trillion yuan ($142 billion) for new lending. This move may be followed by further reductions depending on liquidity conditions.

Interest Rate Cuts: The PBOC will reduce the seven-day reverse repo rate, its new benchmark, by 0.2 percentage points to 1.5%, among other cuts.

Property Market Support: Measures such as a 50 basis point reduction in mortgage interest rates and a cut in the minimum down payment requirement to 15% on all homes have been introduced to address the prolonged property market downturn.