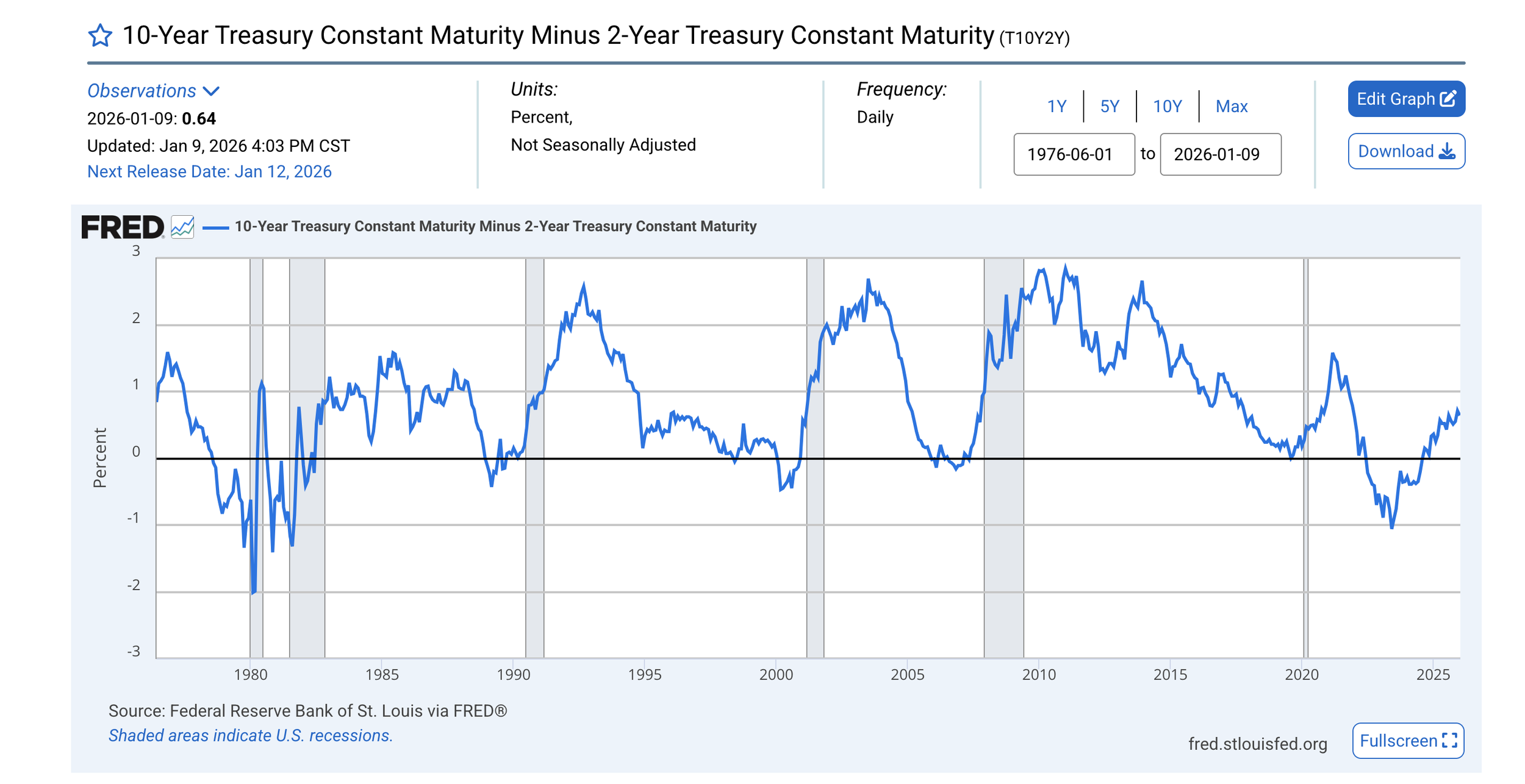

10-year minus 2-year Treasury yield spread turned positive after the longest inversion in history

01/10/2026 12:00 pm EST

AJ Economy Trend - US Down due to concerns of financial instability due to long period of interest rate inversion

The 10-year minus 2-year Treasury yield spread turned positive to about 0.64 percentage points as of early January 2026, marking a clear re-steepening of the curve after the prolonged inversion seen during 2022–2024. That earlier inversion reflected aggressive Federal Reserve tightening and strong recession signals, while the recent move back into positive territory suggests markets are increasingly pricing in easier monetary policy ahead, with short-term yields declining faster than long-term rates. Historically, recessions tend to occur during or shortly after inversions, whereas the re-steepening phase often aligns with late-cycle slowing or the early stages of policy easing rather than the start of a robust expansion. As a result, the current modestly positive slope points to reduced near-term financial stress but does not yet signal a strong growth rebound, especially given ongoing labor-market cooling and lingering inflation uncertainty.

University of Michigan’s consumer sentiment index edged higher, although concerns of inflation still impact consumers

01/09/2026 12:00 pm EST

AJ Economy Trend - US Down due to concerns of prices and consumer sentiments still linger with the impact of high inflation.

The University of Michigan’s consumer sentiment index edged higher for a second straight month, rising to 54.0 in January 2026—its highest reading since September 2025 and slightly above expectations—reflecting a modest improvement in household economic perceptions. The gains were driven largely by lower-income consumers, while sentiment among higher-income households softened. Despite the recent uptick, overall sentiment remains about 25% below its level a year earlier, underscoring persistent concerns about elevated prices and a cooling labor market, even as worries about tariffs have begun to ease. Short-term inflation expectations were unchanged at 4.2%, the lowest since early 2025 but still well above year-ago levels, while long-term inflation expectations edged up to 3.4%, hinting at lingering inflation unease among consumers.

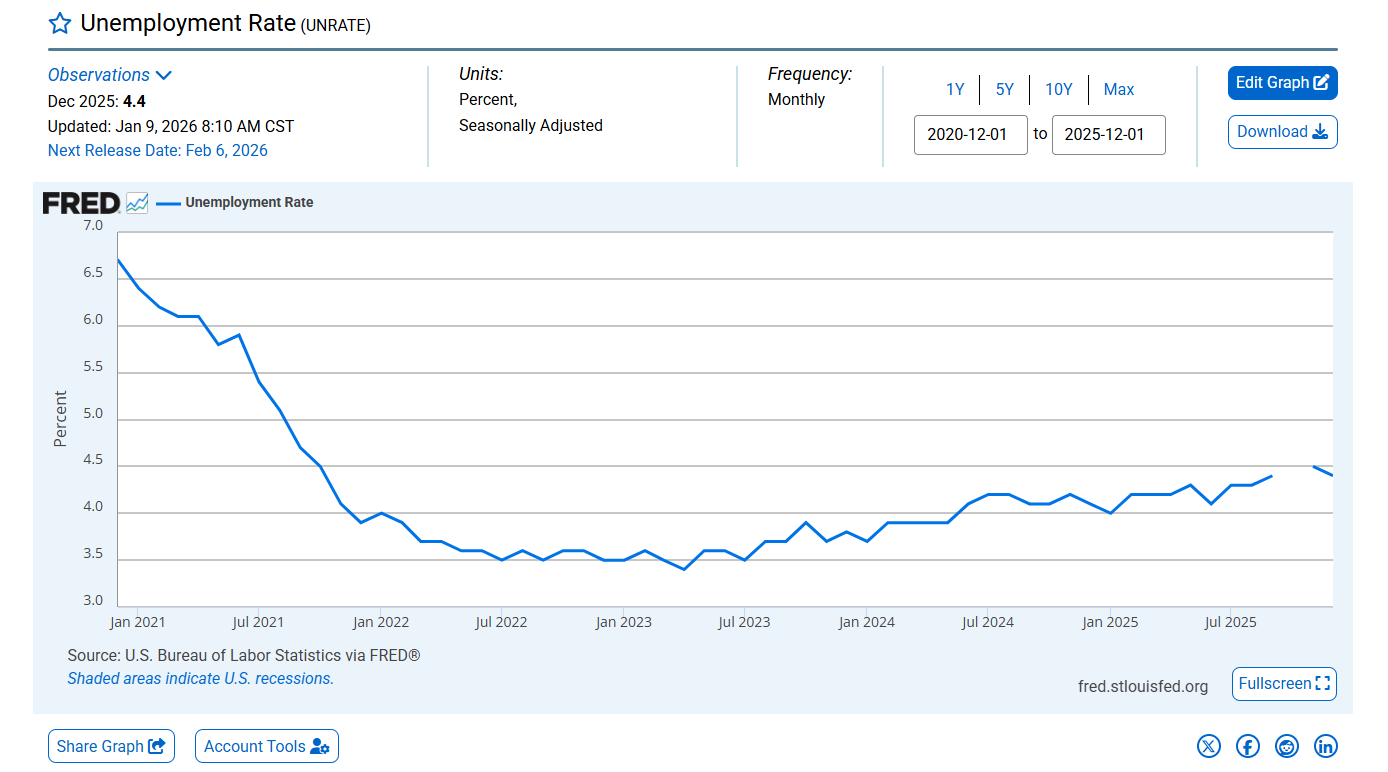

U.S. unemployment rate edged lower to 4.4% in December 2025, coming in below expectations, payroll growth slowed to 50,000

01/09/2026 12:00 pm EST

AJ Economy Trend - US Down due to revised rising unemployment rate and slowdown of payroll growth to just 50,000 jobs. 2025 delivered the weakest annual employment gain since 2003.

The U.S. unemployment rate edged lower to 4.4% in December 2025, coming in below expectations and retreating from November’s four-year high, signaling tentative stabilization in labor market conditions. The improvement was driven by a sizable drop in the number of unemployed alongside solid employment gains, even as the labor force contracted slightly and participation ticked down. Importantly, broader labor market slack also eased, with the U-6 unemployment rate falling to its lowest level in several months. Overall, the data suggest that while hiring momentum remains uneven and participation has softened, pressures in the labor market are no longer intensifying and may be beginning to ease at the margin.

The December jobs report pointed to a markedly softer labor market backdrop, with payroll growth slowing to just 50,000 jobs and confirming that 2025 delivered the weakest annual employment gain since 2003. While the unemployment rate edged down to 4.4%, the modest improvement in joblessness contrasts with the pronounced slowdown in hiring momentum over the past

Canada’s unemployment rate edged up to 6.8% in December 2025, exceeding expectations

01/09/2026 12:00 pm EST

AJ Economy Trend - Canada Down due to rising unemployment rate and showing slowdown of economy

Canada’s unemployment rate edged up to 6.8% in December 2025, exceeding expectations, as a surge of new labor market entrants outweighed modest job gains. The increase partly reversed the notable declines seen over the previous two months, reflecting stronger participation rather than outright job losses. While employment continued to improve for a fourth consecutive month—driven by a solid rise in full-time positions—this was offset by a sharp drop in part-time work. Overall, the data point to a labor market that is still adding jobs but facing renewed slack as improved confidence draws more people back into the workforce.

Private sector employment rebounded by 41,000, fell short of expectations of 47,000 increase

01/08/2026 12:00 pm EST

AJ Economy Trend - US Down due to increase falling short from expectation and hiring concentration is not in business, information and manufacturing but education and health

Private sector employment in the U.S. rebounded by 41,000 jobs in December 2025, recovering from a revised 29,000 decline in November, though the gain fell slightly short of expectations for a 47,000 increase. Hiring was concentrated in services, led by education and health services (+39K) and leisure and hospitality (+24K), alongside moderate gains in trade, transportation and utilities, financial activities, and construction. These increases were partly offset by continued job losses in professional and business services, information, and manufacturing, highlighting uneven momentum across sectors. By firm size, small businesses returned to modest growth, medium-sized firms drove most of the gains, and large firms added very few jobs. Wage dynamics remained mixed: pay growth for job-stayers held steady at 4.4% year over year, while job-changers saw faster wage gains at 6.6%, signaling persistent competition for labor in select areas despite overall subdued hiring conditions.

Initial jobless claims rose modestly to 208,000 in the week ending January 3rd, continuing claims rise

01/08/2026 12:00 pm EST

AJ Economy Trend - US Down due to rising initial jobless claims and higher continuing claims, with insured unemployment rising to 1.91million

Initial jobless claims rose modestly to 208,000 in the week ending January 3, up 8,000 from the prior week, but remained at levels consistent with a still-resilient labor market. Notably, the four-week moving average fell to 211,750, its lowest reading since April 2024, highlighting the ongoing absence of a sustained pickup in layoffs. At the same time, continuing claims ticked higher, with insured unemployment rising to 1.91 million and the insured unemployment rate holding at 1.2%, suggesting that while layoffs remain limited, reemployment is taking somewhat longer. Unadjusted data showed larger seasonal increases typical for early January, including a jump in state insured unemployment, but year-ago comparisons were broadly stable. Overall, the report points to low firing activity alongside gradually softening labor-market turnover, consistent with a cooling—but not deteriorating—employment backdrop.

The employment gauge of the ISM Manufacturing PMI edged up to 44.9 in December 2025

01/06/2026 12:00 pm EST

AJ Economy Trend - US Neutral due to ISM Manufacturing PMI climbed slightly but still remained under the historical average of 50.1

The employment gauge of the ISM Manufacturing PMI edged up modestly to 44.9 in December 2025 from 44.0 in November, but it remained firmly in contraction territory, marking a tenth consecutive month below the 50 threshold. Despite the slight improvement, the reading underscores continued weakness in manufacturing labor demand, with firms still prioritizing headcount management over hiring amid elevated costs and uncertain demand.

Historically, the index has averaged about 50.1 since 1950, highlighting how subdued current conditions remain relative to long-term norms, even though the latest reading is well above the extreme lows seen during past downturns.

Japan’s S&P Manufacturing PMI rose to 49.7 in December 2025, highest reading since August

01/04/2026 12:00 pm EST

AJ Economy Trend - Japan Neutral due to better manufacturing number in November, signaling ease of manufacturing downturn

The S&P Global Japan Manufacturing PMI rose to 49.7 in December 2025, up from 48.7 in November and above expectations, marking its highest reading since August and signaling that the manufacturing downturn is beginning to ease. Demand conditions improved, with goods demand contracting at the slowest pace in around 18 months, although export orders continued to fall amid weak external demand. Employment expanded, reflecting firmer domestic demand conditions, while the decline in unfinished work softened to an 18-month low, suggesting stabilization in production pipelines. On the inflation front, input cost pressures intensified, with operating cost inflation accelerating to its strongest pace in eight months. Looking ahead, business confidence remained constructive, with manufacturers expecting output to grow through 2026, supported by anticipated demand improvements, new product launches, and expansion into new markets.